The second chapter of my forthcoming book It’s All About the Income (May 2022) kicks off with a picture of a unicorn to make the point that there’s no such thing as pure safety, a government-backed investment that “produces high levels of reliable income.” My point is not subtle and in general I’m sticking to it. True financial safety requires a diversified approach, a mix of investments of which some will always be underperforming at any given time.

Yet I’m being proven wrong as I write. I was alerted to this a few months ago on a call with Tom, a smart man who was spending hours educating himself on the ins and outs of personal finance. He’d been spending time on Tik Tok and asked me about a U.S. government-backed bond that pays just over 7 percent. I smelled a scam, explaining that risk always comes with reward, that the 10-year treasury just broached 2 percent, and that this must be a junk bond. “You’re getting ripped off,” I condescended.

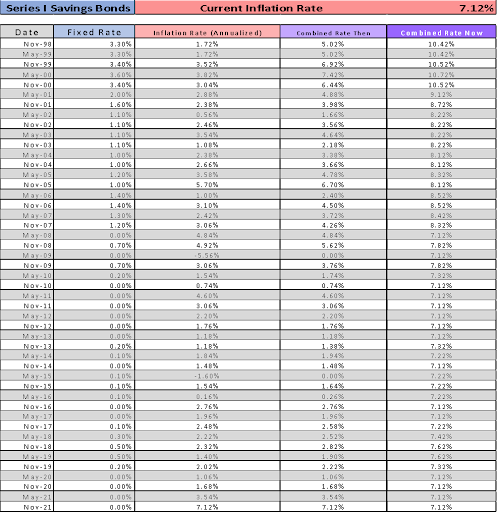

I was wrong. Very wrong. And I owe Tom an apology for my arrogance. He was referring to Series I Savings Bonds (I Bonds) that as of November 2021 were paying a six-month interest rate of 7.12 percent annualized on newly purchased paper.

I’ve been pulling penance for my ignorance and arrogance by discussing this opportunity in one-on-one meetings. But it’s long overdue to blast the news. This is not a recommendation to purchase these securities from the U.S. government. They may or may not be appropriate for you. They may work for your financial plan or just be an annoyance. That’s for you to decide. If you want advice, you know where to get me.

That said, here’s the skinny.

I Bonds date back to 1998. They are the direct version of Treasury Inflation Protected Securities and have some important differences. They can only be purchased directly from the government on treasurydirect.com or through a tax return. Each person is limited to $10,000 worth a year, plus a potential for $5,000 more paper bonds purchased with tax refunds.

This provides a strange incentive to overpay taxes to generate a refund of this magnitude. Here’s a hack. Make a fourth quarter estimated tax payment of $5,000 on January 15th. You won’t be providing Uncle Sam much float.

The bonds mature in 30 years and taxation on the interest is deferred until you cash them in. (You can elect to pay the taxes each year if you prefer.) The principal value will never go negative. You must hold them for at least one year. If you cash them in prior to five years, you will give back three months interest. After five years they are fully liquid without any penalty.

These are the cousins to Series EE Savings Bonds, the traditional U.S. Savings bonds. The returns comprise two features. First, the underlying interest rate, which is currently zero. This rate is set at issue for each bond and will never change.

The second component is a principal adjustment for inflation that is based on the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CFI-U). This index includes energy and food, two of the leading expenditures for many consumers. This rate resets twice a year, in November and again in May. Your bond will reset every six months in the month in which it was purchased.

Given the recent price spikes, the rate jumped to 7.15 annualized in November 2021. As the table below illustrates, some purchasers of I Bonds in previous years are already enjoying 10 percent or higher returns due to base interest rates of more than 3 percent in earlier times. Hence my Unicorn, almost. In my defense, there have been plenty of years in which these bonds did not produce high income. Therefore, the current rate of return can’t be considered reliable.

I like to say that there’s always something good going down somewhere in personal finance opportunities. Right now, I Bonds present an interesting opportunity for risk-averse investors who seek inflation linked interest rates. The only drawbacks are the small quantity of these bonds which you can purchase and the inconvenient fact that, given today’s high prices, the real returns are set at zero. That’s still better than what banks are offering.

Any discussion of taxes is for general informational purposes only, does not purport to be complete or to cover every situation, and should not be construed as legal, tax, or accounting advice. Clients should confer with their qualified legal, tax, and accounting advisors as appropriate. Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. 6 Corporate Drive, Shelton, CT 06484, Tel: 203-513-6000.

CRN202504-2238704